Gifts of Stock: one of the most tax-efficient ways to give

Charitable Tax Credits

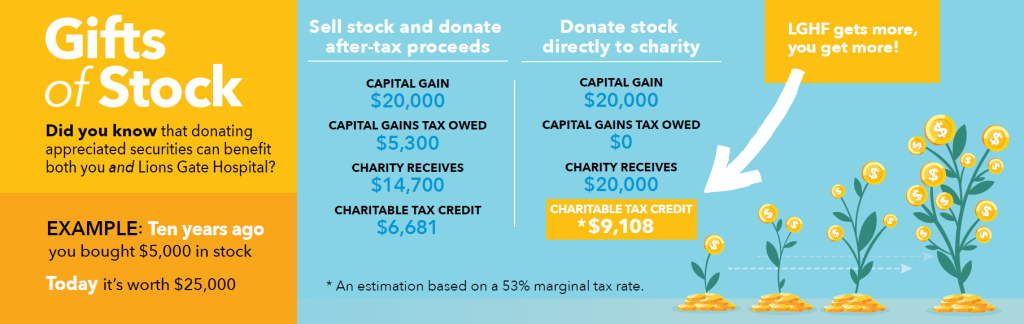

To encourage charitable giving, the government provides donors with a tax credit when they make a donation to a registered charity. This donation tax credit can be used to reduce taxes payable.

If you donate a public security on which with capital gains have accrued, you benefit from the elimination of the capital gains tax plus the donation tax credit. The combined tax savings can be considerable.

Here’s How it Works

- Provide your broker with our Letter of Direction and ask them to transfer shares of eligible securities directly to Lions Gate Hospital Foundation.

- Once securities are received, LGHF will sell the securities and issue a charitable donation receipt for the fair market value of the securities.

- Your gift is exempt from any capital gains tax on the appreciated securities.

Download our Letter of Direction

Questions? I am here to help.

I would be pleased to answer your questions and provide additional information on gifts of securities. Please contact me at any time.

Carolyn Anderson

Director of Planned Giving

Email: Carolyn.Anderson@vch.ca

Phone: 604-984-5857